18 to 29 years old

Recommended Balance

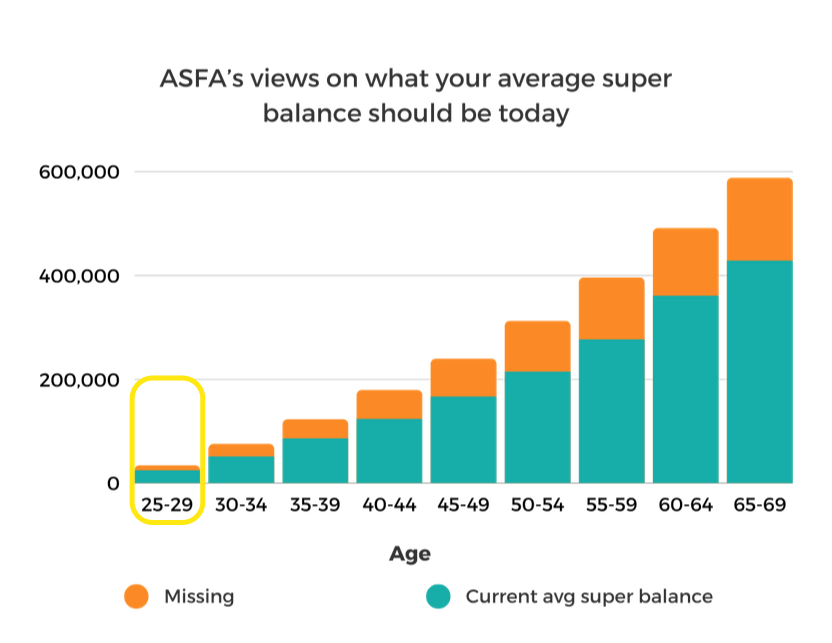

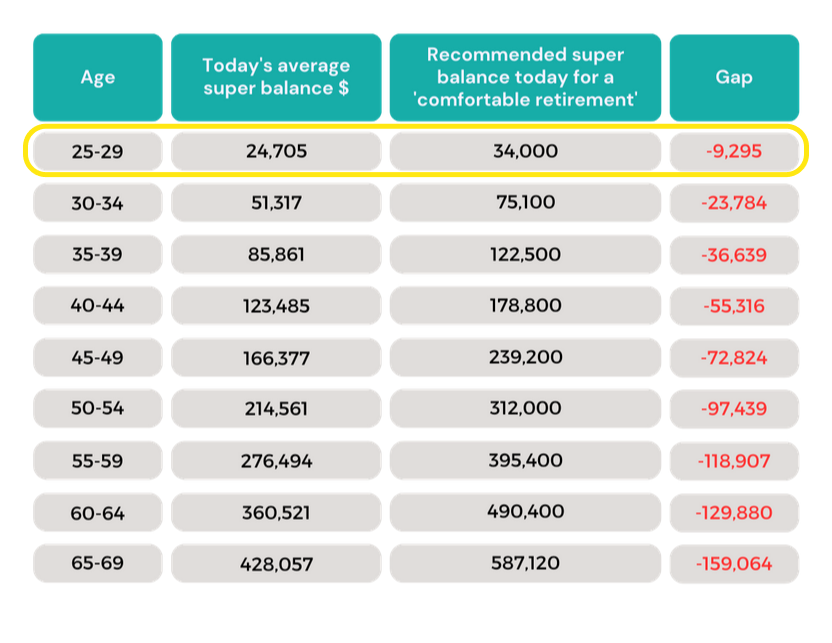

Those aged between 18-29 are on average $16,500 behind the recommended super balance. If this is you, it's not your fault but it's an issue you'll want to address. That's where we come in!

If you're between 18 and 29, it's crucial to grasp the significance of superannuation in shaping a secure financial future. In these formative years, understanding how your super balance stacks up against others in your age bracket isn't just about numbers—it's a stepping stone towards lifelong financial well-being.

Establishing what you should ideally have in your super at this stage sets a realistic and achievable goal, guiding you towards a future where financial stability is not a dream, but a well-planned reality. By focusing on your superannuation now, you're not just saving for retirement; you're investing in a future that allows for freedom and choice in your later years.

Recommended super balances have been calculated using ASFA’s Super Guru

Super Balance Detective Calculator, averaged across different age groups. These figures are compared against

ATO 2021-22 Retirement Statistics (Snapshot Table 5) - Super balance by age and sex

How do I take action if there’s a gap?

1. Regularly compare: your superannuation funds performance with the market.

2. Consolidate your superannuation accounts: Fresh from university or starting a new job, you might have multiple super accounts without realising it. Consolidate them to save on fees and ensure your retirement savings are in one place.

3. Start Early: Start contributing early, regularly and add more super if you can. Even modest contributions in your 20s can lead to significant growth due to the magic of compound interest.

4. Investment options: Check in with your investment options over time. As a young individual, you can afford to take slightly higher risks. Consider choosing a growth-oriented investment option, which usually has a higher percentage of shares and property.

How much super do I need for a ‘Comfortable Retirement’?

According to the Association of Superannuation Funds of Australia Limited (ASFA) Retirement standard explainer, for those wanting a ‘comfortable retirement', the average super balance at retirement should be around $690,000 for couples and around $595,000 for singles.

How much is ‘enough’, is different for every individual. It's essential to recognise that each individual's financial needs and lifestyle aspirations are unique. What constitutes a comfortable living for one person might differ vastly for another. Guidelines can provide a foundational perspective, personalising your retirement planning based on your unique circumstances and aspirations is paramount.

Get Started Today!

Do you have a specific question?

Send an enquiry

(We usually reply within 24 hours)

Ask our Super Bot

FAQs

-

CONSOLIDATING AND COMPARING YOUR FUNDS

- Compare funds - Take advantage of a superannuation comparison website to examine how your fund measures up against the highest-performing funds. Despite the fact that performance may fluctuate from year to year and past performance is not an indication of future results, it's sensible, if possible, to choose a fund with a positive reputation for success and stability.

- Decide - Choose a fund that suits your financial needs

- Check your insurance - Guarantee that you are able to attain a suitable insurance level in the fund of your selection.

- Open an account - When selecting a super fund, don't forget to create an account with them and obtain all the information that your employer would need in order to make contributions. Be sure you are completely satisfied with the insurance level before making any changes!

- Notify your employer - Make sure your employer is aware of where to put in your superannuation payments, as well as how to properly identify you when transferring money into the fund.

- Roll over super to your selected fund - For a more in-depth look, visit the Australian Taxation Office (ATO)'s monitoring of your superannuation page. The easy way to do this is through myGov online - and if you wish to move your balance over to another fund, simply contact them via website or phone!

-

WHY CONSOLIDATE MULTIPLE FUNDS INTO ONE?

With a variety of administration fees, charges and life insurance premiums associated with different super funds, having multiple accounts may lead to paying more than is necessary. Maintaining just one fund means you will only have to pay one set of fees so that your super can grow faster.

-

WHAT IS SALARY SACRIFICE AND HOW DOES IT WORK?

Salary sacrifice is an arrangement where you agree to forego a portion of your salary to contribute extra to your superannuation. These contributions are made before tax, potentially lowering your taxable income. This can be a tax-effective way to increase your super balance, but it's important to consider contribution limits and personal circumstances.

Read our case study HERE.

We are passionate about empowering individuals to achieve their financial goals, secure their retirement and their family’s future.

ABN: 18 666 648 595 | ACN: 666 648 595

We are partnered with

AS Financial Planning & Other Top Firms who are authorised to give financial advice on behalf of a licensee.

Services

Get In Touch

Email:

hello@ausupersolutions.com.au

13.01, 222 Pitt Street, Sydney CBD, NSW, 2000

Disclaimer

The information on this website is General Information only and therefore does NOT take into consideration your personal financial situation, objectives and needs. Prior to acting on any information on this website you should consider what is appropriate for your own personal financial situation, objectives and needs. Aus Super Solutions is not associated or affiliated with any super funds, we aren’t a financial advisory firm, we do not sell financial products nor do we give financial advice. Our role is to connect clients with fully licensed financial advisors that operate compliantly under an Australian Financial Services Licence. Aus Super Solutions does not take in any way responsibility for any advice or recommendations provided by the financial advisors. Prior to acting on any advice provided by the financial advisor you should and can ask as many questions as you deem necessary to ensure you have received the right advice for your personal financial situation. All fees and costs must be clearly explained and after speaking with a referred advisor you are under no obligation to commit to any recommendations made nor cost payable to Aus Super Solutions should you decide against the advice provided. Before making any decisions regarding your super you should obtain the super fund’s Product Disclosure Statement (PDS) and consider its contents. However our goal and mission is to only recommend and connect clients with fully licensed financial advisors and firms with established, positive track records in enhancing and servicing their clients financial situation, objectives and needs.

© Copyright 2023. All rights reserved. Aus Super Solutions Pty Ltd | Terms & Privacy | Disclaimer